Financial giants have made a conspicuous bullish move on Advanced Micro Devices. Our analysis of options history for Advanced Micro Devices (NASDAQ:AMD) revealed 130 unusual trades.

Delving into the details, we found 53% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 14 were puts, with a value of $632,864, and 116 were calls, valued at $8,392,535.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $70.0 to $165.0 for Advanced Micro Devices during the past quarter.

Analyzing Volume & Open Interest

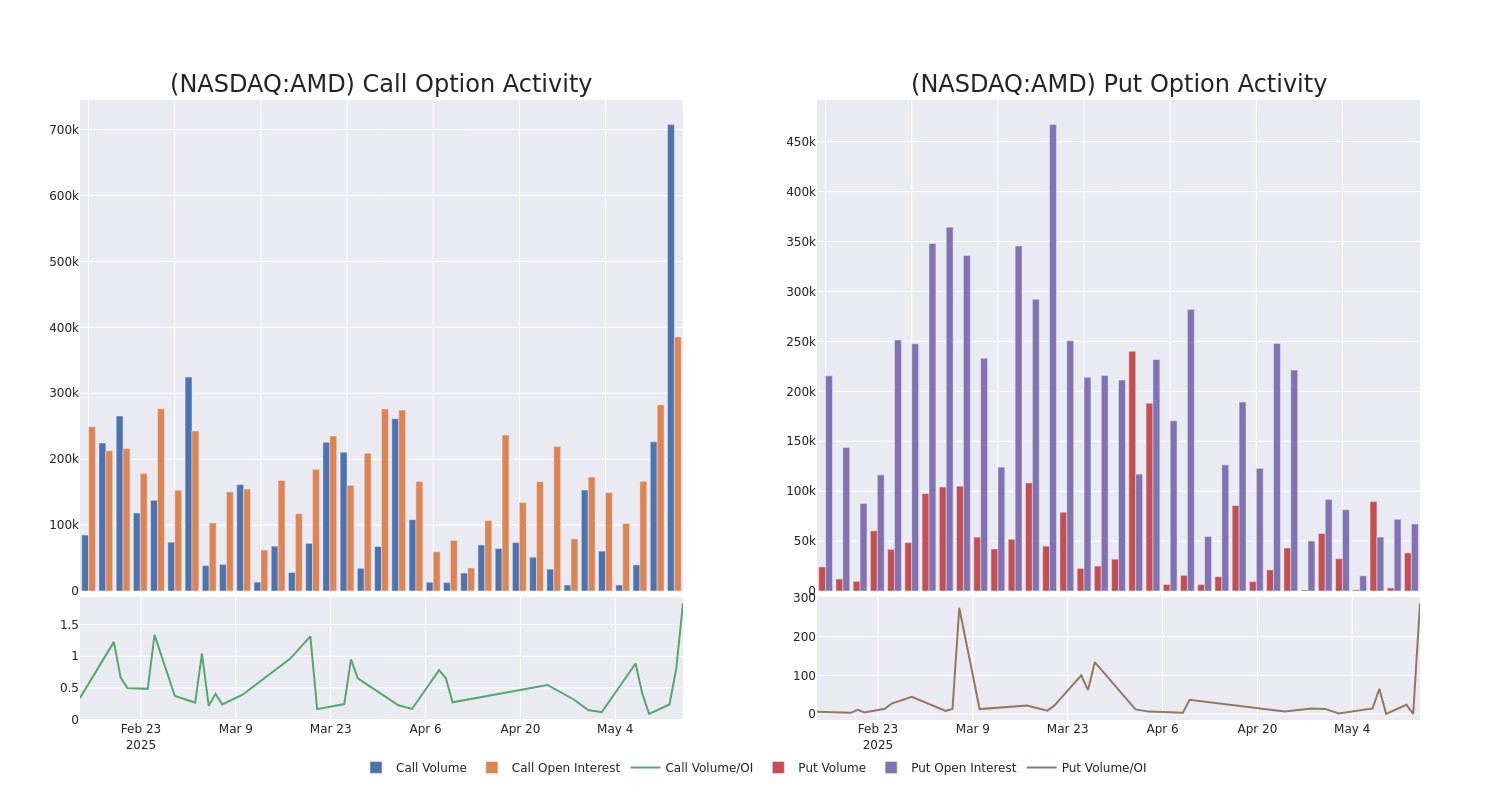

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Advanced Micro Devices’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Advanced Micro Devices’s whale activity within a strike price range from $70.0 to $165.0 in the last 30 days.

Advanced Micro Devices 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMD | CALL | SWEEP | BULLISH | 11/21/25 | $17.8 | $17.5 | $17.58 | $120.00 | $497.3K | 4.8K | 965 |

| AMD | CALL | SWEEP | NEUTRAL | 05/16/25 | $11.35 | $11.25 | $11.17 | $110.00 | $344.2K | 25.4K | 2.7K |

| AMD | CALL | SWEEP | BULLISH | 05/16/25 | $11.25 | $11.0 | $11.35 | $110.00 | $281.0K | 25.4K | 2.4K |

| AMD | CALL | SWEEP | BULLISH | 11/21/25 | $17.65 | $17.5 | $17.57 | $120.00 | $207.7K | 4.8K | 649 |

| AMD | CALL | SWEEP | BEARISH | 05/16/25 | $11.3 | $11.2 | $11.25 | $110.00 | $180.4K | 25.4K | 2.9K |

About Advanced Micro Devices

Advanced Micro Devices designs a variety of digital semiconductors for markets such as PCs, gaming consoles, data centers, industrial, and automotive applications. AMD’s traditional strength was in central processing units and graphics processing units used in PCs and data centers. Additionally, the firm supplies the chips found in prominent game consoles such as the Sony PlayStation and Microsoft Xbox. In 2022, the firm acquired field-programmable gate array leader Xilinx to diversify its business and augment its opportunities in key end markets such as data center and automotive.

In light of the recent options history for Advanced Micro Devices, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Advanced Micro Devices’s Current Market Status

- Trading volume stands at 21,901,141, with AMD’s price up by 6.87%, positioned at $120.19.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 76 days.

Professional Analyst Ratings for Advanced Micro Devices

In the last month, 5 experts released ratings on this stock with an average target price of $125.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Susquehanna keeps a Positive rating on Advanced Micro Devices with a target price of $135.

* An analyst from Baird has decided to maintain their Outperform rating on Advanced Micro Devices, which currently sits at a price target of $140.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Advanced Micro Devices with a target price of $110.

* An analyst from Stifel persists with their Buy rating on Advanced Micro Devices, maintaining a target price of $132.

* An analyst from Seaport Global has revised its rating downward to Buy, adjusting the price target to $110.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Advanced Micro Devices with Benzinga Pro for real-time alerts.