During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga’s extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the energy sector.

Delek Logistics Partners, LP (NYSE:DKL)

- Dividend Yield: 10.34%

- Raymond James analyst Justin Jenkins maintained an Outperform rating and increased the price target from $44 to $46 on Jan. 28, 2025. This analyst has an accuracy rate of 78%.

- Truist Securities analyst Neal Dingmann maintained a Buy rating and raised the price target from $46 to $50 on Nov. 18, 2024. This analyst has an accuracy rate of 63%.

- Recent News: On Feb. 25, Delek Logistics Partners posted better-than-expected quarterly earnings.

- Benzinga Pro’s real-time newsfeed alerted to latest DKL news.

Plains All American Pipeline, L.P. (NASDAQ:PAA)

- Dividend Yield: 7.53%

- Raymond James analyst Justin Jenkins maintained a Strong Buy rating and raised the price target from $23 to $24 on Jan. 28, 2025. This analyst has an accuracy rate of 78%.

- Barclays analyst Theresa Chen maintained an Underweight rating and increased the price target from $18 to $19 on Jan. 16, 2025. This analyst has an accuracy rate of 77%.

- Recent News: On Feb. 7, Plains All American Pipeline reported fourth-quarter revenue of $12.402 billion, missing the consensus of $13.742 billion.

- Benzinga Pro’s real-time newsfeed alerted to latest PAA news

Enterprise Products Partners L.P. (NYSE:EPD)

- Dividend Yield: 6.29%

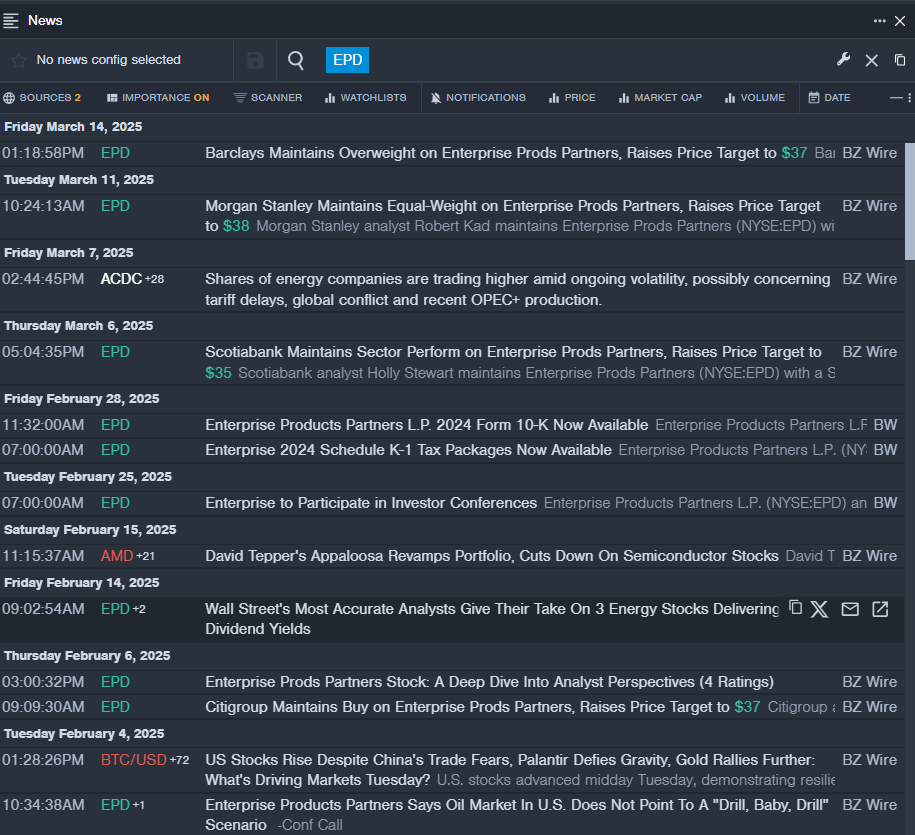

- Barclays analyst Theresa Chenmaintained an Overweight rating and raised the price target from $35 to $37 on March 14, 2025. This analyst has an accuracy rate of 77%.

- Morgan Stanley analyst Robert Kad maintained an Equal-Weight rating and increased the price target from $36 to $38 on March 11, 2025. This analyst has an accuracy rate of 79%.

- Recent News: On Feb. 4, Enterprise Products Partners reported a fourth-quarter 2024 sales decline of 2.9% year over year to $14.201 billion, beating the consensus of $14.161 billion.

- Benzinga Pro’s real-time newsfeed alerted to latest EPD news

Read More: